Key messages about the gas-fired recovery

- ‘Natural gas’ is a fossil fuel (methane)

- Methane leakage rates can make gas as bad as coal

- Methane contributes 25% of global heating

- New gas is not needed, and will not lower prices

- New gas will not produce more manufacturing jobs

- Gas is not a transition fuel, we can move straight to renewables and storage

- Gas cooking is responsible for 12% of childhood asthma

- There are safer and cleaner alternatives for domestic heating, cooking and in industry

- Green hydrogen is on its way – zero emissions with a wide range of industrial uses and export potential, and will help decarbonise difficult sectors like steel.

“Gas is not a transition fuel to a safe climate. That ship has sailed. Planned and rapid coal-to-renewables switching is now the responsible path. Gas will have a role in the near term, certainly, but the science is clear. The role of gas needs to be a significantly declining one, not a growing one, if we are to avoid the worst of climate change.”

Penny Sackett, Chief Scientist, 2008-2011

Key Gas Facts

1) Gas is a dirty fuel, probably worse than coal

Fugitive emissions – flaring and leakage

- Statements that fossil gas (methane) is “50% better” than coal refer to combustion only (p. 25) and ignore flaring and leakage along supply chain and waste CO2% in the fossil gas.

- At 2-3% fugitive emissions (flaring and leakage), gas is as dirty as coal. (Literature survey p26 cited in IEEFA’s Submission to the IPC).

IEEFA cite GISERA’s report on whole of life emissions Section 4.2: “A general consensus has emerged from these studies that the climate benefits of natural gas replacing coal are lost where fugitive emissions from all upstream operations are greater than 3% of total production (Alvarez et al 2012; Zavala-Araiza et al 2015). IEEFA notes the 2% figure comes from when a shorter 20-year time frame as opposed to the normal 100-year frame from Professor Ian Lowe’s correspondence. - Some fracking wells in the USA have been leaking methane at 30% (p. 31).

- New satellite data, for instance from the upcoming MethaneSAT, will improve our understanding of how much methane is leaking and where. A GHGSat detected “giant” leaks from 8 pipelines in Turkmenistan, and is capable of picking out leaks “from individual wells.” A recent satellite mapping of the Permian Basin showed many point sources, with flux rates ranging from 500-6000 kg/hr although one was detected at over 18,000 kg/hr. These major emitters correlated with recent wells, where the authors concluded that gas collection infrastructure had not kept pace with the productivity of the new wells, with obvious governance implications for flaring of methane.

- New research suggests that the impact of industrially produced methane gas on global heating has been underestimated by “25-40% of recent estimates” – as the Guardian reports, “Placing stricter methane emission regulations on the fossil fuel industry will have the potential to reduce future global warming to a larger extent than previously thought.”

-

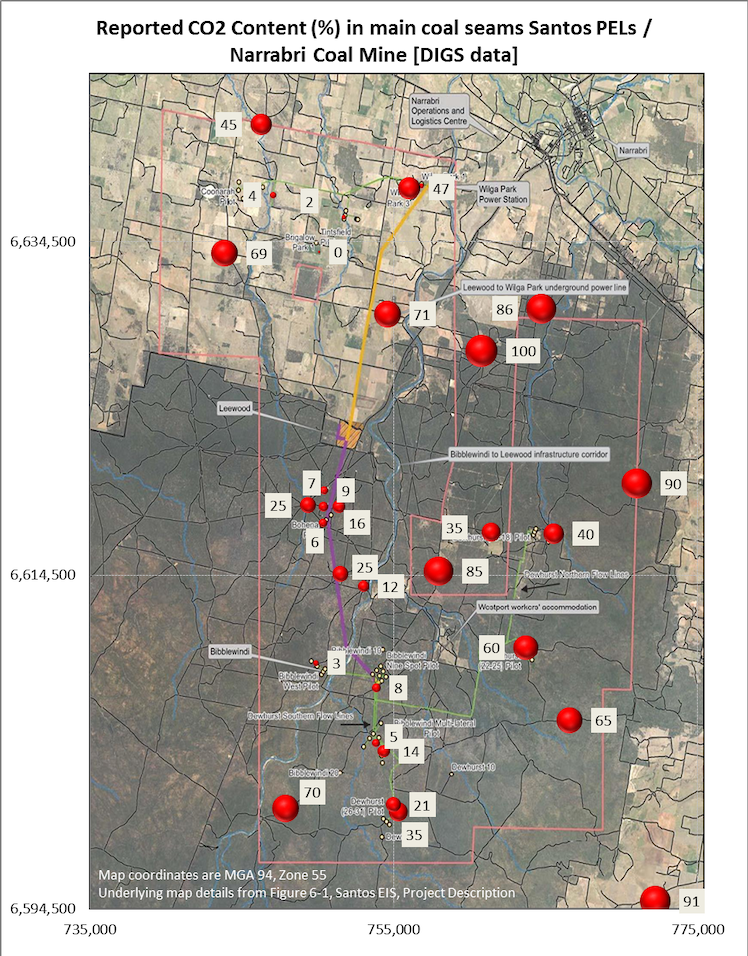

New gas is getting dirtier with higher percentages of waste CO2, making it more expensive to extract.

CO2 concentrations of Gas Wells Narrabri NWPA

-

The gas distribution networks also leak (p.22) at 3-4% (Victoria).

The way fugitive emissions figures are calculated matters

- In Australia, gas projects are allowed to use emissions factors of 0.0058% in calculating fugitive emissions. Australia cites 0.5% to the UN, the US EPA uses 1.4%, but BP cites 3.2% across the industry (Bloomberg$ cited in IEEFA Submission to IPC).

- For the Narrabri Gas Project, GISERA’s 0.0058% produces Santos’ 20,000 t CO2e statement which underlies the Government’s statement that gas would reduce emissions, whereas using 1.4% would produce a much larger figure of 537,000tCO2e narrowing the idea that gas is cleaner. (Dr Grogan, NWPA)

Methane is worth 25% of global heating – Alvarez et al, 2018

- “Scientists estimate that the methane in the atmosphere contributes to about 25% of global warming, Alvarez says” (this includes the gas industry as well as other sources such as the permafrost).

Potential emissions from the proposed pivot to gas could be massive

- The Australia Institute: “Australia’s already identified gas resources, if burned, would have a climate impact larger than annual emissions from any country”, or even larger if all potential sources for gas extraction in Australia were considered – “Combustion emissions potential from prospective resources is staggeringly large, almost three years of annual fossil fuel emissions from the entire world, and one year and eight months of global emissions from all sources.”

2) Gas will play an ever diminishing role

New gas is not needed, gas is only needed for peaking and we can move away from gas and switch to renewables and storage

New gas for power is not needed says AEMO

- “further investment in GPG is less likely based on the assumptions used in this ISP”

- Climate Action Tracker (p. 3)- only need gas for peaking for electricity generation in the short term, and the shortfall can be replaced with fuel switching and demand management in the short to medium term.

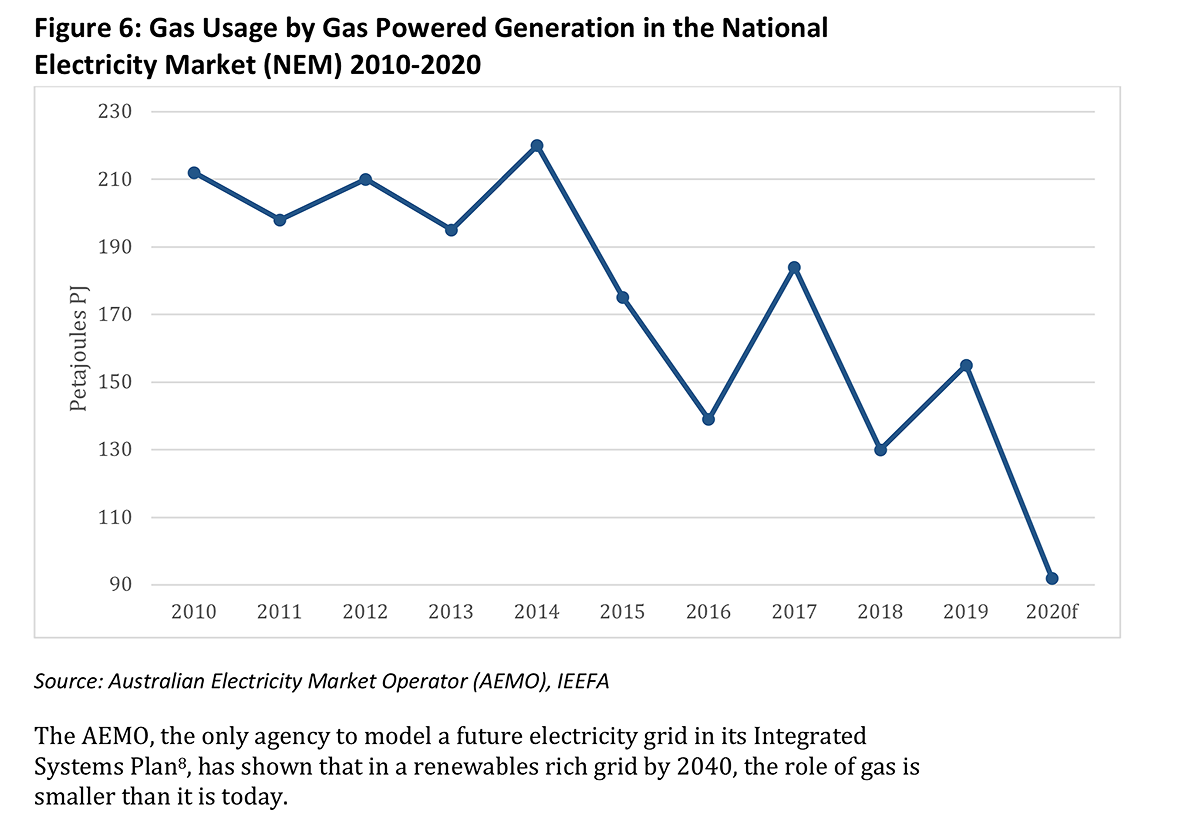

AEMO IEEFA Gas Powered Generation in the National Electricity Market is declining

“Gas is not a transition fuel” – IEEFA

- “Far from seeing the “gas powered recovery” our politicians desire, we are seeing a gas fired depression around the globe. In the U.S., the number of operating drill rigs has fallen 73% in the last 12 months. And US LNG exports have more than halved so far in 2020.”

- “Since 2010 renewables have grown by approximately 148% whilst nuclear plus fossil fuels have declined by 38%”

- “Many high heat applications for gas can be substituted with cheap renewable power. Some however cannot and so we need some gas production. The federal and NSW state governments have set the level of gas needed at 70PJ pa. Gas use in residential and commercial applications can largely be substituted for cheaper electrical heating, in the form of air conditioners, induction cooking and heat pumps for hot water. This would free up to 190PJ pa and dwarf the contribution from Narrabri.”

-

“Large-scale use of gas as a transition fuel – supplying ‘baseload power’ with lower emissions than coal – does not stack-up economically or environmentally.” Grattan Institute, p.35

We are not listening to our export customers

- China, Korea and Japan are making mid century net zero commitments and pivoting towards to renewables, limiting our ability to export fossil fuels.

Batteries

- Grid scale batteries are becoming competitive, already saving money on grid support services, and will increasingly displace gas peaking.

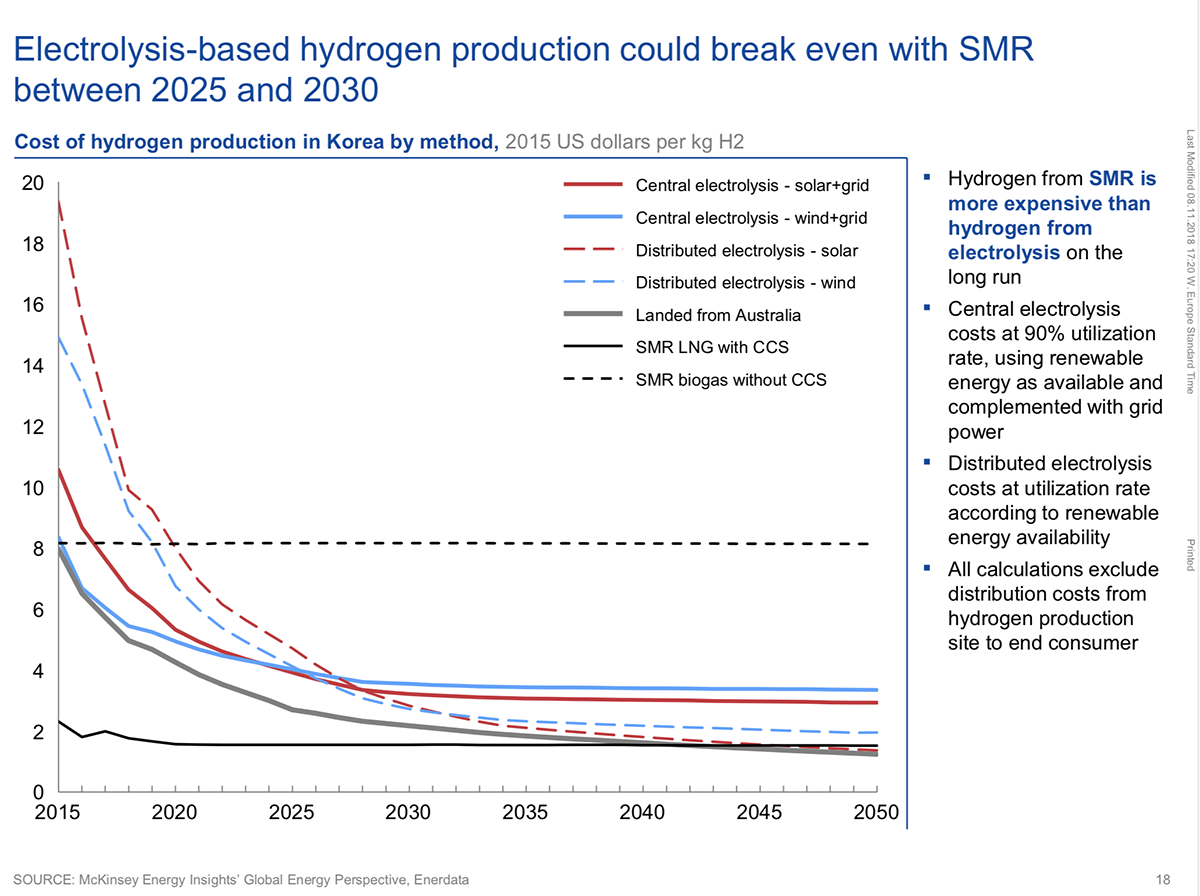

Hydrogen and large scale renewables

- In the medium term hydrogen/ammonia, clean electrons and embedded energy in clean manufactured goods will displace coal and gas for exports (Korea, Hydrogen Energy Roadmap pp. 10,19).

3) New gas will not create jobs or lower either gas or electricity prices

Increasing supply has not reduced prices

- Supply has tripled, this has not reduced domestic gas prices – they have tripled. The only way to reduce prices is a gas reservation policy.

- Adding expensive new gas will not lower domestic gas prices as the gas companies will just export cheaper overseas gas.

- Gas companies are keeping the gas market “starved” in Australia (Bruce Robertson interview) which keeps prices high.

Electricity prices are linked to gas prices

- ACCC: “for every $1/GJ rise in gas prices, the wholesale price of electricity rises by up to $11/MWh” “The effect of inflated gas prices on electricity prices is profound… placing a massive burden on the entire economy, not just gas consumers.” IEEFA submission to IPC

New gas is a poor stimulus to new jobs

- New gas is unlikely result in many more new manufacturing jobs: Grattan Institute: “Even if the Government could significantly reduce gas prices, the benefits to manufacturing are overstated. The companies that would benefit most contribute only about 0.1 per cent of gross domestic product, and employ only a little more than 10,000 people”.

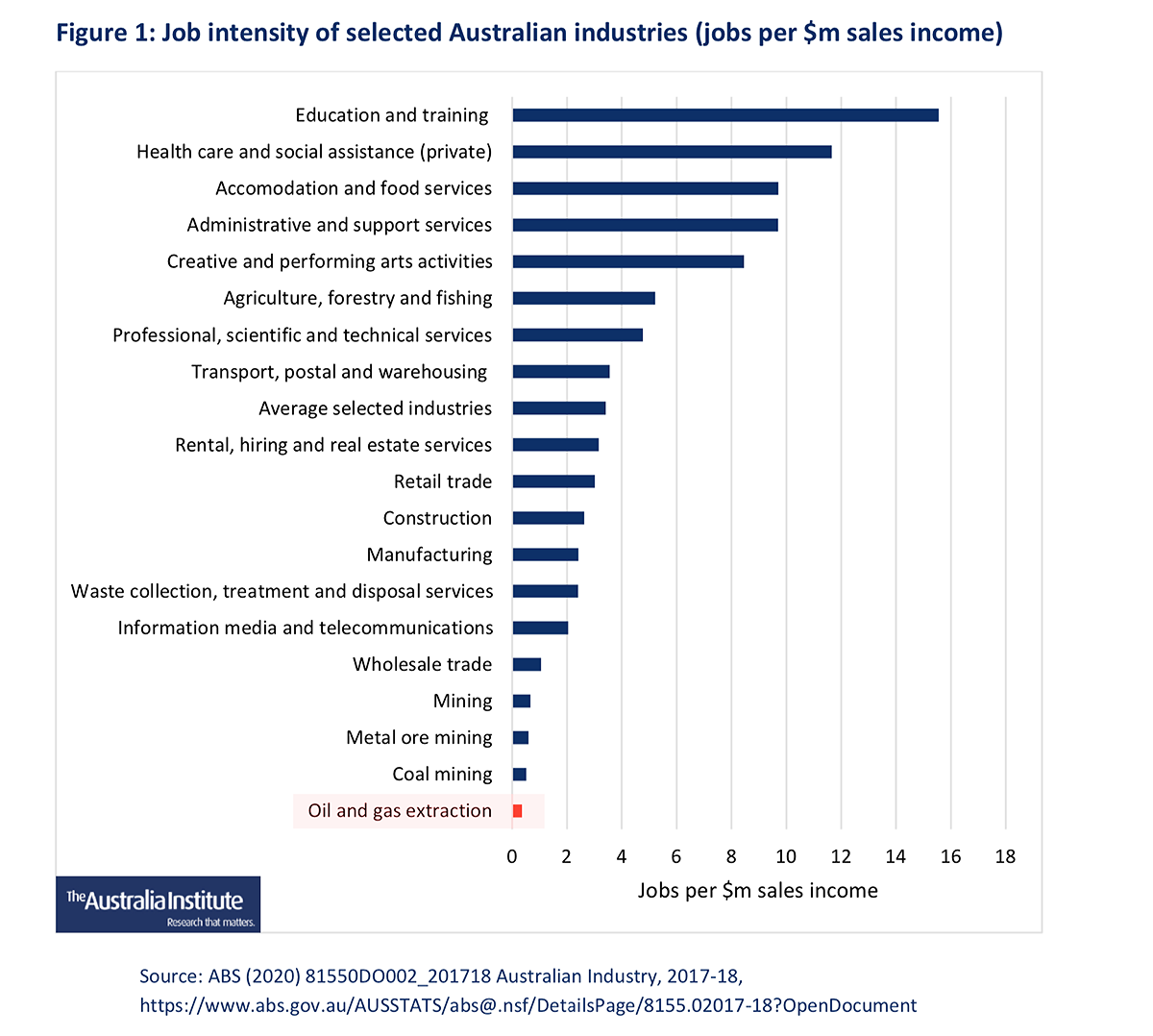

- The Australia Institute (p. 4): “For every million dollars of sales income, only around 0.4 jobs are created on mining gas. The average for all Australian industries is 3.4 jobs.”

4) Gas expansion is offering public money to an industry in trouble

Large public subsidies

- Gas fired recovery is an opportunity for public subsidies not just for infrastructure such as pipelines, but also to subsidies gas itself in the form of off-take agreements

- ACCC Chairman Rod Simms: “What the government is proposing is basically transitioning us onto gas, not transitioning us off gas.”

- The ACCC is concerned that “if the government instructs Snowy Hydro to build a new gas plant, its unlikely to see out its economic life, meaning the taxpayer picks up the bill…we’re looking at a 30 to 40-year commitment to gas”

Write-offs and debt

- Bruce Robertson, IEEFA: “The gas industry in Australia, and the Australian government, are flogging a dead horse by introducing a gas-led recovery while our key export markets are intent both on reducing emissions, and on reducing imports of Australian LNG…Australian gas companies have lost between 50% and 70% of their value since 2011. In just the first six months of this year, Australia’s gas industry suffered $25 billion in write-offs. If low oil prices persist, we’ll see even more write downs. That means that any government subsidies provided to this loss-making industry will be banked to pay shareholders and prop up debt, rather than investing in new gas.”

Corporate capture

- Morrison’s “ handpicked” National Covid Commission, is making recommendations, despite conflicts of interest, where Australia would be committing a large amount (“billions”) of tax payer funds to medium term infrastructure, not their ostensible short term Covid recovery remit.

- Richard Dennis, TAI: “the best way to get the gas industry to invest in new gas wells is to promise to buy enormous amounts of gas at an agreed price for the next 20 or 30 years.”

5) Water, environmental and health impacts

Water and fire risks

- High risk of water depressurisation/ damage to aquifers Environment Defenders Office’s evidence

- Surface water contamination risks including disposal of salt waste.

- Fire risks: Greg Mullins says that new gas is “unthinkable” after the catastrophic summer fires, creating unmanageable risks to workers and volunteer firefighters, “It’s not a risk I would be prepared to put people into.”

Environmental impacts

- Incompatible with agriculture – physical disruption from roads and traffic, reputational damage, stock sickness and death

- Long term: low birth weight, fatal damage, heart, respiratory and neurological effects, elevated cancer risks

- Short term: severe nosebleeds, headaches, hair loss, allergies, asthma

6) There are alternatives – fuel switching and demand management

Fuel switching and heat pumps

- Heat pumps (which include reverse cycle air conditioners) are very efficient compared to gas-fired heating and when coupled with solar or green power can offer zero emissions heating and cooling.

- Grattan Institute: “Going all-electric is the no-regrets option, offering lower emissions at an affordable cost today.”

- 500,000 – 1m households in eastern Australia may be unaware that they can use their existing reverse cycle air conditioners for heating, saving money and freeing up gas for industry.

- More jurisdictions are banning or moving past new connections to gas, with $9-16,000 saved over ten years.

- Electrification could “unfetter up to 190 petajoules (PJ) per annum and dwarf the contribution of at best 70PJ from Narrabri.” IEEFA Submission to the Independent Planning Commission

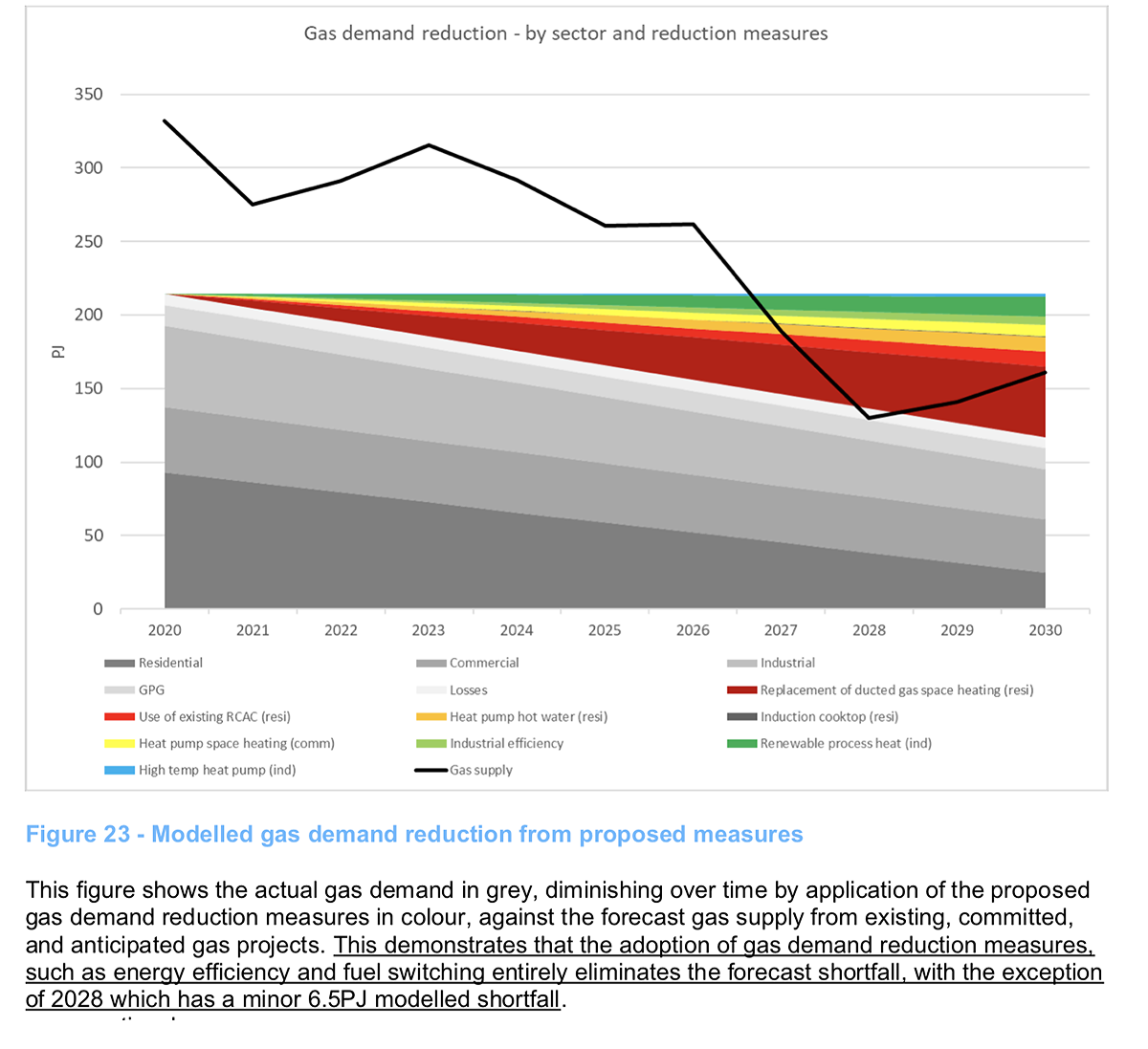

Demand management, mitigating shortfall

- Energy efficiency measures reduce the demand for heating and cooling.

- Full demand reduction and fuel switching “entirely eliminates” Victoria’s forecast gas shortfall according the Northmore Gordon report Additional pathways include stronger electrification efforts in industry (halving energy usage).