On Wednesday 29 April at 7:30 pm we welcomed Pablo Brait and Rachel Deans from Market Forces. This is a report of the meeting.

Pablo Brait

It is necessary to align your finances with your values. Many money-managing organisations still invest in the fossil fuel (FF) industry.

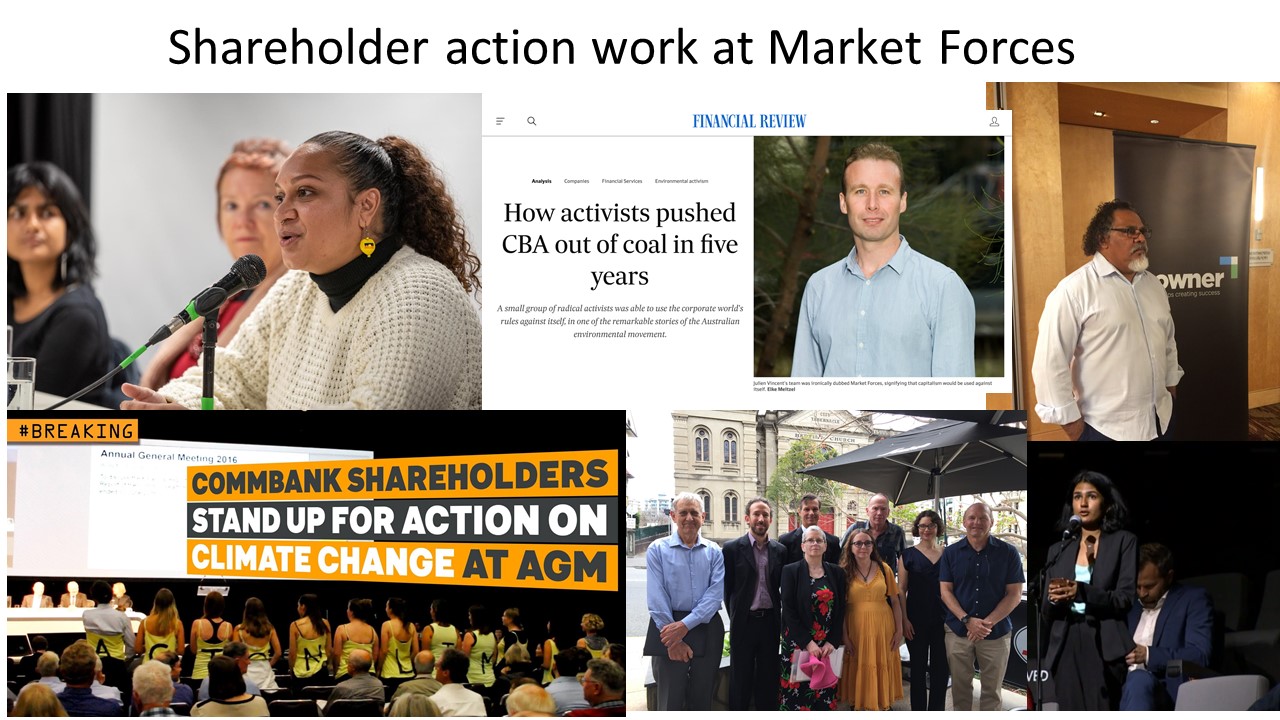

Market Forces (MF) is totally independent and does research to inform the public about how their money is being used.

There are three key things that the FF industry needs from the finance industry:

- debt,

- insurance and

- investors.

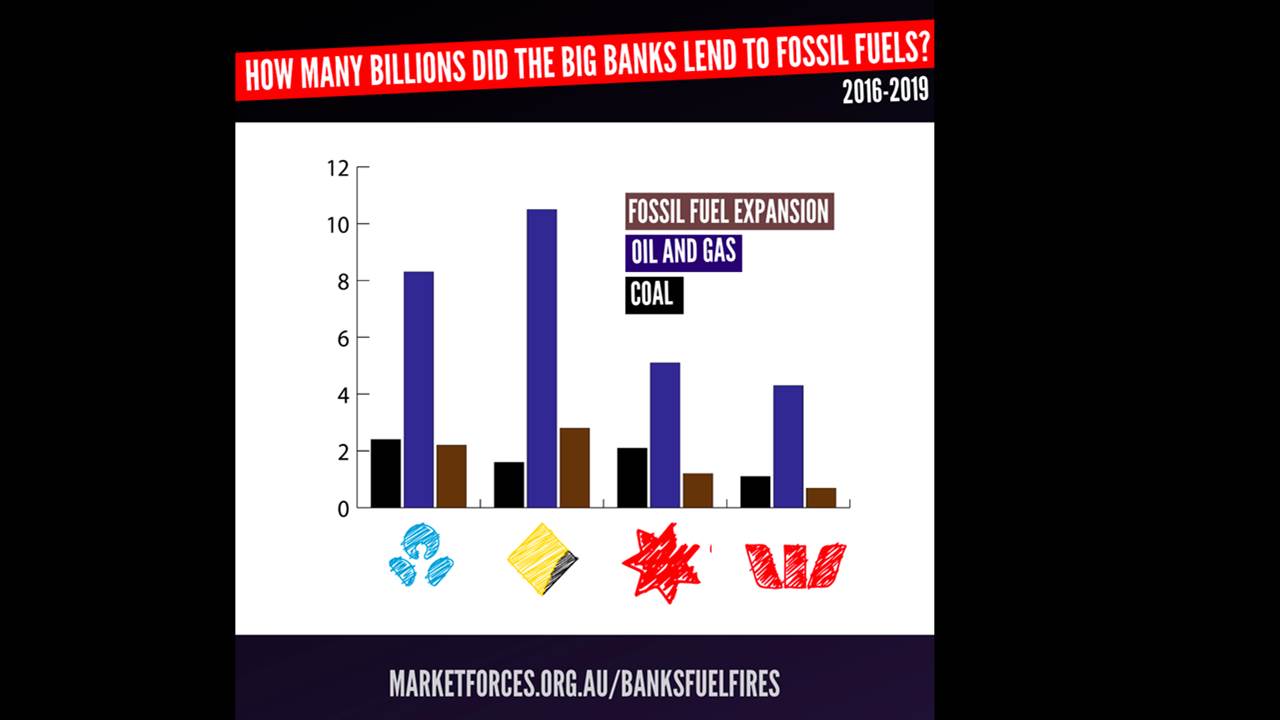

Debt – such as bank loans and bonds. In the last 4 years since their pledge to the Paris Agreement, FF lending by the Big 4 banks has continued with $7.1 billion going to FF expansion (coal, oil and gas).

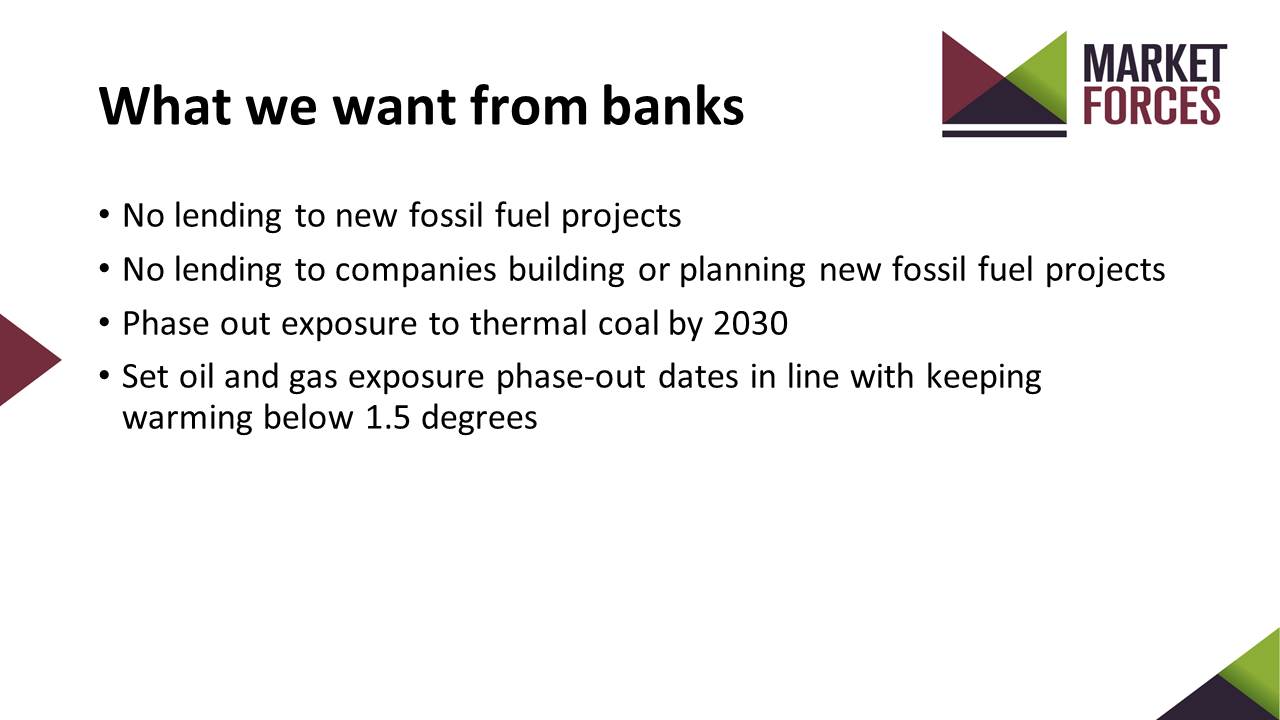

This has to stop. In order to meet the 1.5 degree aim of the Paris Agreement, lending to FF projects must cease, and companies that lend to them must stop (or be stopped). The banks are starting to move, with Westpac and Commbank committing to have zero exposure to thermal coal by 2030.

This has been achieved through collective action: public campaigning, targeting the bank’s brand on-line and off-line, and by mobilising customers, shareholders and the general public to take action.

And it’s working!

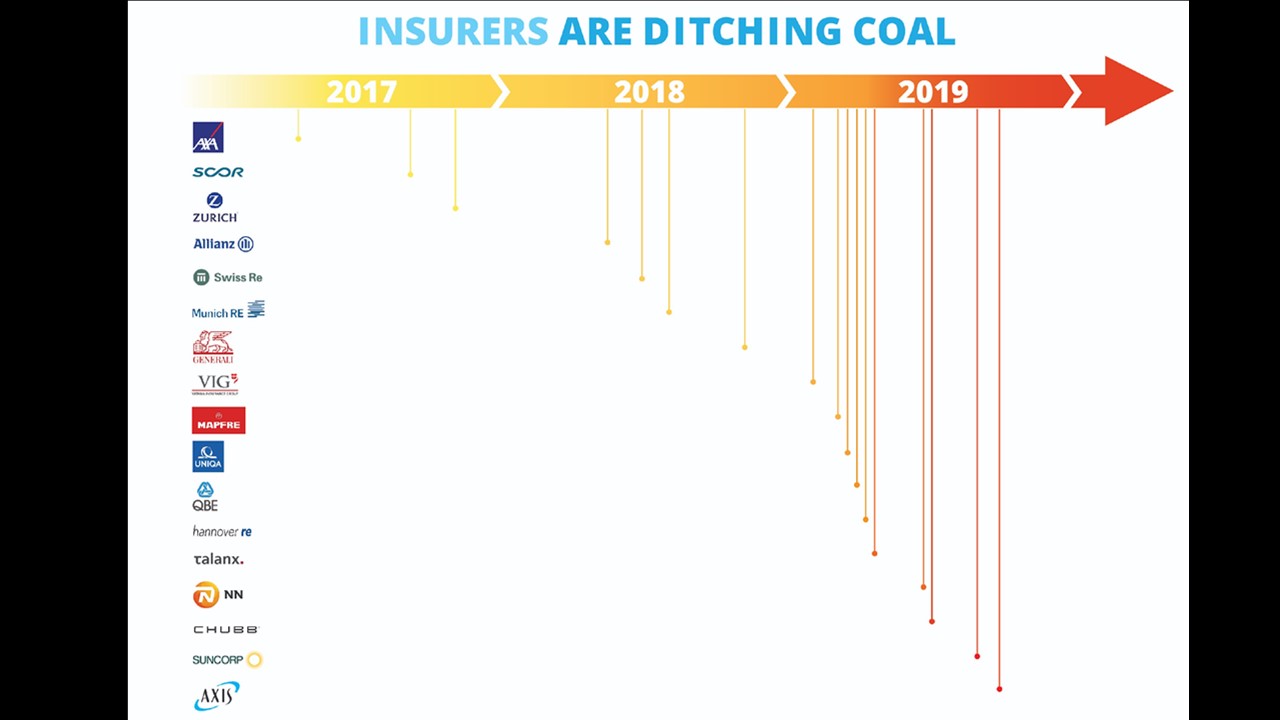

Last year there were 41 announcements of restricted lending to coal. This year there have been 25 such announcements already!

Insurance – plays a key role. The FF projects can’t go ahead without insurance (e.g. legal liability, directors and operations insurance). Insurance companies are under pressure due to increasing extreme weather events, so they should not be insuring the FF industry and there has been an acceleration of such announcements: IAG out of coal by 2023; Suncorp by 2025 and QBE (most involved in FF) out by 2030. QBE has its AGM on the 7th May. MF are currently campaigning for QBE to divest out of coal and gas.

Donuts for a score of “0” on climate action!

Investors – Adani has started construction (despite a 7 year delay) of the rail link, and in the face of COVID-19. The Big 4 banks won’t loan to them and 16 insurance companies will not insure them. There is a list of the companies collaborating with Adani on the MF website: the Adani List and there is a letter there that you can send to them to take action.

Rachel Deans

Shareholders in the companies we target attend the AGMs. It’s often the only time we can have dialogue with executives and board members about climate change. AGMs in the current COVID crisis are online. Some companies are using it to cut short question times or screen questions prior to the meeting – this is not on! Consider signing on to MF’s latest action and email ASIC to make sure shareholder rights are upheld at online AGMs.

There is $3 trillion ($3000 billion) invested in Super funds, and you have a lot of power to influence your super fund to shift away from FF! There is often not a lot of transparency from the super funds – we need to push for more.

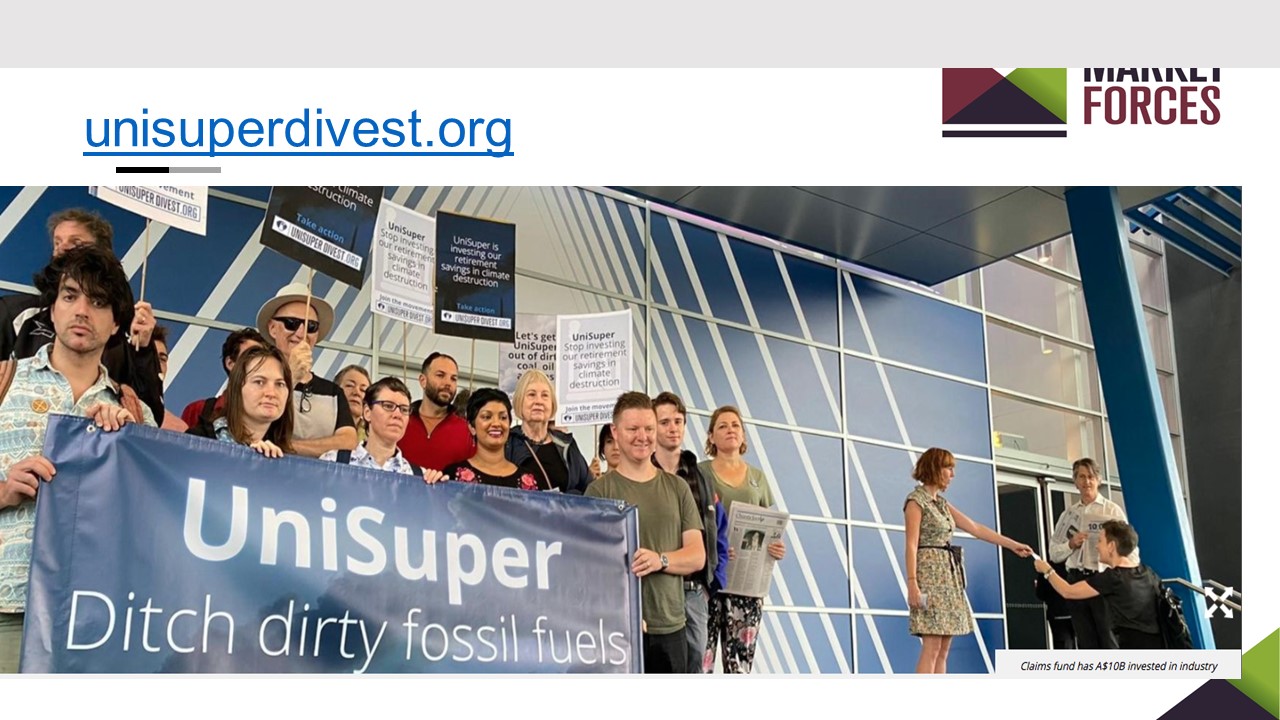

22 companies have been found to be completely out of line with the Paris Agreement. MF is actively campaigning to stop UniSuper’s investments in FF: you should join the campaign to get UniSuper to divest! MF is only able to work with share holders to influence their super funds. So sign up to Market Forces to learn more about how you can influence your super fund.

Questions and Answers with the presenters

Q. Is it better to switch banks, or pressure your present bank?

A. A balance of both is best, so it is personal. Ask yourself – are you happy with your bank’s contributions to FF? Do you want to switch? If you switch, do so in a public way, put it on social media, tell MF. It encourages others to make a stand.

Q. Should we have a “foot in both camps” and invest across multiple banks?

A. ME and Bank Australia don’t lend to FF. MF have a list of banks that lend to FF.

Q. What is the latest on the Adani campaign?

A. 66 corporations have agreed not to back Adani. Insurance is still critical. MF do not believe that Adani has all the insurance they need. The insurance companies that might insure them are part of the 16 who said they won’t insure them any further. (Negotiations between Marsh and Lloyds fell through). American AIG are a bit bullish in insuring coal and a potential danger.

Q. How does the Super Funds Rating Table work? Is it more difficult to switch super funds than switching banks? What is the issue with Balanced, Stable and other account types?

A. Super rating is determined by the type of investment they make, e.g. coal mines, forests etc.

Pushing from the inside and switching are both good. If you’re switching, make it public so it makes the super funds listen.

Q. Should we attack the super funds based on their responsibilities to get the right investments?

A. Yes. We need to ensure that our super funds are investing in a healthy future for us and future generations. If our super funds keep investing in fossil fuels, then our investments are ensuring a dangerous climate for us and future generations. Burning fossil fuels will lead to more than 1.5 degrees of warming. Super funds are investing our money, so we need to make sure we’re happy with the things they are investing in.

Q. Should we use Ethical Advisers?

A. You need a financial adviser and should choose an ethical one.

Q. What should we do about online AGMs and their taking of questions?

A. It is important to have the board and CEO listening. If enough shareholders speak up it leads to movement. The understanding of boards has shifted significantly, e.g. QBE changed their policy to not fund coal in part because of a shareholder resolution, as well as a sustained campaign on QBE.

Q. Is the govt trying to stop activism?

A. The govt singled out MF which is an attack on freedom and democracy. MF provides information to help the public act. This could not be made illegal, the govt was just sending a message to their fossil fuel friends.

Follow-up

Re-live the night via the Facebook Live recording or our Tweet string.

Access the speaker slides here.

And for further information, or to get on Market Forces mailing list, please visit their website: